Case Study

He has an urge to succeed. He decides to follow his dream and go into investment banking. Before learning of Into City Prep he takes the traditional route and spends hundreds of tedious hours sending online applications to every bank out there.

He re-reads every word on his CV and online form 20 times to make sure the spacing matches perfectly, there are no missing commas and he quintuple checks for every single formatting error known to mankind. He also adds in every bit of extracurricular work, leadership activities and relevant work experience. However since industry-wide success rates for graduate applications are around 0.25% per application he gets dozens of emails informing him “there has been unusually high interest in our job opportunities this year” and therefore he will not be invited to interview. Harry feels depressed – thoughts of graduating and remaining unemployed for years keep haunting his mind.

Finally after two grueling months a miracle happens! A small corporate finance firm on the city outskirts has one extra space for the summer and decides to bring him in for an interview. Harry is really excited and sets out to prepare.

The big day has arrived. Harry visibly nervous but full of hope walks into the interview room and mentally reviews all the scripted answers he memorized for every interview question he could think of. A VP strolls in: “how do you determine the fair value of a miss-priced high-growth e-commerce division within a loss-making software firm and how would your answer vary depending on composition of the firm’s capital structure?” OH SNAP! This has nothing to do with the stuff covered in his BSc Accounting & Finance degree and Harry has no clue what to say. He tries to “improvise” and blurts out a long-winded answer. Once he finishes speaking he has no idea what he just said. The interview goes on with a few more questions like this and Harry feels like he’s dying inside.

Ten days later the hammer strikes: “The team was delighted to meet you and we greatly appreciate your time in attending an interview, unfortunately there has been very strong competition for places this year however we encourage you to try again next summer.”

The process repeats itself with three more firms where each time the interviewer catches him out with some technical question he never thought of. Harry is shattered. He knows that if he fails to land an internship in the summer after his penultimate year it’s going to be very difficult to get any graduate role. He oscillates between frustration and sadness but has no idea what to do about it.

One day after a dull accounting lecture Harry learns about Into City Prep from one of his classmates who just landed an IBD summer role at Morgan Stanley. Harry decides to take a different approach and he enrolls for the Into City Prep training internship in banking comprised of industry placement and bespoke 1-to-1 technical finance mentoring. He gets the best experience of his life. In 4 weeks he goes through:

Thorough overview of key financial statement items;

Full income statement build-out in Excel top-down and bottom-up;

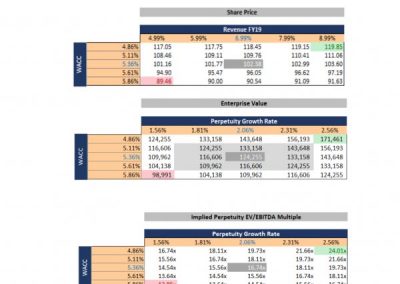

What enterprise value really means and how to think of it;

Dealing with tricky items like non-debt liabilities, restricted cash, pension deficits etc;

Valuation (intrinsic and comparables) - Excel implementation and intuition behind it;

Key points about LBOs, M&A models, SOTP analysis and asset spin-offs;

What matters and what doesn't - how to cut the fluff and save time when dealing with technical finance questions in interviews;

How to apply your technical skills to ace Excel modelling tests (frequent in investment banking and inevitable in private equity) or assessment centre case studies;

How to tie everything together and decisively show interviewers that you master the skills and concepts needed to help their firm save time and generate revenue.

Now everything is so much clearer! After the training internship, Harry has a strong technical foundation thoroughly covered in an easy-to-understand manner and with a focus on relevance to interview questions and how to get the job offer rather than vague academic details. Complete with Excel skills and how to use this knowledge in the real world. Harry feels 100x more confident about going to interviews and showing the work he created to employers as proof of his abilities.

Even better, the training internship teaches him a few tricks to get back in the game at this late stage of the application cycle. Abandoning the low-value online application approach forever, Harry uses Into City Prep’s techniques to line up interviews at three boutique investment banks. With solid technical finance skills and a great edge over his peers, Harry smashes the interviews and secures two offers for summer roles. Through some good hustle he manages to defer the starting date of his second offer so he can do both roles instead of one. He gets 2x the income over the summer and by August he manages to convert both internships into graduate job offers starting straight after he graduates. Adding to his winning position he also throw his now-shinning CV at GS and JPMorgan to maximize his options and pick the highest-paying offer. Harry has never been happier in his life.

Over the summer he collects $18,000 in salary from his internships ($9,000 each) and his first year IBD salary is over $105,000. In total Harry has invested around $6,000 in himself by working with Into City Prep – he recovered the entire amount through the summer internships with 200% profit and afterwards he makes more than 10x return on investment during his first year on the job.

As a bonus, Harry becomes part of the Into City Prep Network, an exclusive community of high-achievers, which can open doors for its members throughout their lifetimes.